Last Updated on August 2, 2023 by Steven W. Giovinco

<h1]]>The Importance of Online Reputation Management for Hedge Funds and How to Repair a Damaged One</h1]]>

See Related Article: Calculating the Value of Online Reputation Management

Hedge funds can be highly susceptible to online reputation management problems from a variety of sources. Since one deal can be worth many millions of dollars and losses can pile up quickly.

Hedge funds need to have a stellar online reputation because damages can be extremely costly.

Whether it be business- or event-driven, convertible arbitrage, emerging markets, fixed-income arbitrage, industry-specific catalyst, long-short, macro, or market-neutral funds, small-cap, or activist, it takes one negative article, blog post, or bad news report to be disastrous for the fund and its investors.

Unfortunately, I know this first hand from my clients’ experiences.

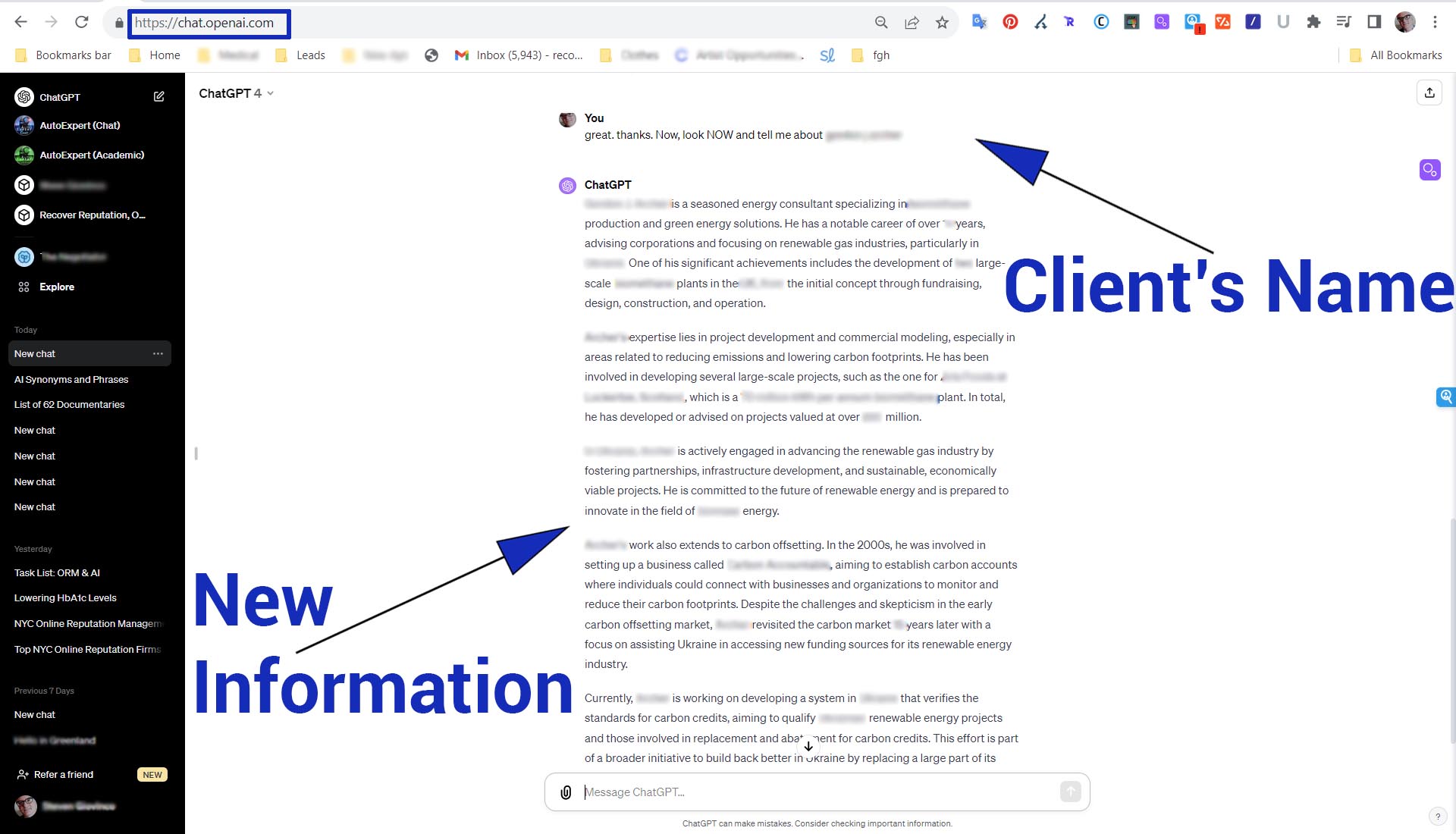

Real-Life Example: RipoffReport On First Page

I recently had a client whose ex-investor became upset over a deal he felt should have gone differently and decided to write a very personal and vicious negative post on the anonymous site RipoffReport. This link immediately shot to the top of the first page of Google search results when searching for him and his company.

Sales were hurt, and some investors left the fund as a result. When attempts to resolve the problem through lengthy and costly legal action failed, an online reputation repair process was initiated and helped. Here are some of my recent experiences with online reputation management for hedge funds.

What Can Go Wrong

It can take just one disgruntled investor writing a complaint on Ripoffreport or another website (as seen above) to potentially impact hundreds of millions of dollars or massive sales losses. Ex-partners, too, unhappy over deals or compensation, can purposely ruin their own fund’s reputation.

Even competitors can effectively (and illegally) damage a hedge fund by spreading false news reports to short a stock or damage it to send it down.

Amazingly, I’ve heard that some disreputable fund managers have corners of their office dedicated to running online smear campaigns against competitors.

Regulatory Issues Specific to Hedge Funds

Before starting the repair process, it is essential to know the various government limitations put in place by the SEC (or by organizations in other countries) and abide by them.

Ignoring these rules, such as promoting or offering sales advice for a specific stock, can lead to additional online or legal damage. Work only with an online reputation firm that has experience in this area.

Online Reputation Repair for Hedge Funds Starts with Research and Questions

The first step in online reputation management is a thorough review of the issue and the business.

What particular regulatory problems do we need to mindful of? Who are potential clients, and are they local or international? Is new content likely to inflame the original poster of the harmful links? Who are the competitors? What is good information already out there? Do the firm’s lawyers need to be consulted? Asking questions and doing research are essential.

Create Good Content

Creating good content and knowing where to place it online is vital. Writing excellent and informative articles added as blog posts to the main business site or elsewhere is one of the best ways to generate good content. Creating presentations or uploading existing ones to sites such as SlideShare.net, for example, is also very effective.

Knowing where to place blog posts is just as important: add to industry-specific sites focused on hedge funds, general investments sites, and ones geared toward the type of fund (e.g., small-cap, etc.) that needs to be repaired.

Social Media

The micro-blogging site Twitter is a major social media platform that is extremely useful, and there are several ways to use it. In my most recent case (and on many others), I identified key industry leaders, news sources, bloggers, and others to connect with or Follow, and then generated Tweets either from the newly published articles on important news that would be of interest to investors or from other excellent sources. Facebook, LinkedIn, and even Instagram can be beneficial too.

Search Engine Optimization

SEO has a role in the repair process. Not to get too technical, but It’s important to update the fund’s site with the correct meta-data for each page and ensure the key search terms are added to the individual pages. Also, it’s essential to make sure the social media platforms have all their profile information correctly completed–including crucial search terms.

Time Frame

This can be a long process. The time frame can vary anywhere from between four to ten months, but most projects take about six whole months to resolve.

Also, additional maintenance work is sometimes necessary after the project is complete to keep the negative links down. Note too that unexpected or unintended news can impact the repair process.

What to Expect

Once the initial research is complete, which takes several weeks to a month, building content and adding it to newly created accounts starts. Usually, the various sites (Twitter, LinkedIn, Facebook, Slideshare, etc.) need to be updated very frequently–sometimes daily.

Slowly, after the second or third month, the negative links begin to become suppressed, and after about six months, the negative links should be pushed down.

The Bottom Line

Pushing negative links off the first few pages is a highly cost-effective way for hedge funds to prevent massive losses due to damaging articles appearing in Google search results and adversely impacting both the investments and investors. Feel free to reach out to me, Steven W. Giovinco at Recover Reputation, with any questions.

Photo Credit: exploring markets via Compfight.

See Related Article: 25 Free Online Reputation Management Tips and Tools